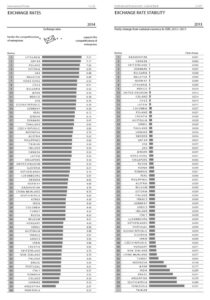

How will currency fluctuations impact competitiveness?

The latest currency fluctuation wave in Europe will indeed impact several competitiveness criteria. In terms of the World Competitiveness Yearbook hard statistics, such an impact will be felt in the long-term. Changes in exchange rates will resonate, for example, in indicators such as stock prices and export sales for 2016 (if not later).

Currency stability, however, is fundamental for the degree of confidence that economic actors have in a particular economy. In this sense, there are competitiveness indicators that will display the impact of fluctuations more substantially in the short-term. We expect therefore that data gathered through our 2015 Executive Opinion Survey will exhibit such an impact. For example, we largely expect survey participants residing in directly affected countries to conceive of exchange rates as a hindrance for the competitiveness of enterprises. In addition, opinions about the resilience of those economies to withstand economic cycles could become unfavourable.

The image abroad or branding of some countries may be affected negatively, which could eventually impact business development in those economies. Respondents may take an adverse stand in regards to the government. For example this could affect their impressions about the adaptability of government policy to changes in the economy, the effectiveness of the implementation of government decision and, in some cases, the likelihood of an increased risk of political instability.

Perceptions about credit availability and the financing of companies could also suffer. It could be the case that respondents find that credit is not easily available for businesses and that the levels of financing to companies are inadequate. In addition, opinions about the banking and financial services could shift. Respondents may perceive a decline in the support that these institutions provide to businesses. Undoubtedly, assessments of risk factors in the financial system will be affected as well as the relationship between the cost of capital and business development. Capital markets (foreign and domestic) could be found as inaccessible. At the same time, survey respondents may find that the investment environment in their respective countries lacks attractiveness for foreign investors.

To sustain competitiveness it is fundamental for countries to maintain the levels of confidence that their institutions enjoy which in turn depends on the perceptions of market agents. In this sense, our Executive Opinion Survey is an accurate tool to gauge and capture market sentiments about current economic events. Be ready then for a “reality check,” we compile the 2015 survey results by the end of May.

Research Information & Knowledge Hub for additional information on IMD publications

The Brics emerging markets are once again touting their ambition to build a world less dependent on the US dollar. Leading the latest push is a new guarantee fund, to curb investment risk and support financing in the bloc, something discussed at l...

When the leaders of the Brics group of developing countries gather on Sunday for their 17th annual summit, the backdrop is one of the most geopolitically volatile the bloc has faced in years, with trade tension, regional conflicts and energy insta...

When Chinese Premier Li Qiang addressed the World Economic Forum’s “Summer Davos” in Tianjin, China, his message was clear: China must become a “mega-sized” consumption powerhouse. Not just the world’s factory, but its market too. His words underl...

For years, multinational companies operated in the Middle East with the belief that while politics could flare up, trade would largely continue. That assumption, while once reasonable, is now under serious strain. The war between Israel and Iran l...

To understand America’s aggressive shift on trade, you must first grasp the silent, slow building, decades-long erosion of American middle-class prosperity. This shift began well before President Trump and will outlive him. It is rooted in the col...

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

in Gensler, Gary (Ed.); Johnson, Simon (Ed.); Panizza Ugo (Ed.); Weder di Mauro, Beatrice (Ed.) / The Economic Consequences of The Second Trump Administration: A Preliminary Assessment, pp. 239-244 / PAris: CEPR Press, 2025

Research Information & Knowledge Hub for additional information on IMD publications

Published by International Institute for Management Development ©2025

Research Information & Knowledge Hub for additional information on IMD publications