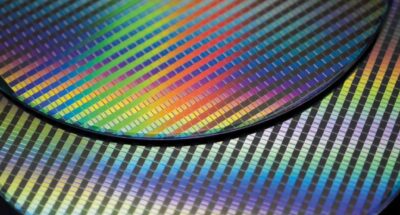

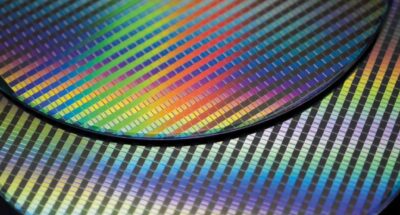

Europe needs Chips Act 2.0 to compete in digital race

Former French finance minister Bruno Le Maire says Europe needs to act urgently to secure its supply of semiconductors or face relegation to the global slow lane. ...

Audio available

June 26, 2023 • by Richard Baldwin in Strategy

The future of trade is intermediate services, says Professor of International Economics Richard Baldwin – and this is good news for workers in emerging markets...

Is globalization dead? No, but it is changing – faster than we think, and in ways that we haven’t anticipated. Globalization is transforming as we speak into being less about industry, mining, and agriculture and more about services, which are weightless.

This is going to fundamentally change how the world does business. It will change the pathway of development, with emerging markets benefiting the most. And for those of us living in rich countries, it will fundamentally change the way we live and work.

First, some facts. One: the world goods trade has peaked. This is very clear, if you plot the world export of goods on a graph as a percentage of the world’s GDP. From 1993 to 2008, the world exports of goods rose quickly during the period of hyperglobalization or the global value chain revolution. Then the financial crisis happened, which led to a huge collapse in global trade. The system bounced back from it, but the goods trade has been on a bumpy downward trend ever since.

In contrast, the global exports of services did not peak, or even plateau; they continued to grow. Moreover, the divergence between the growth paths has become quite large. If you look at the trends in values since 1998, services have risen by 15 times, but goods have only risen by nine. If that growth rate difference persists, then within decades, services will represent more than half of all world commerce.

What’s behind this? Two things that are advancing simultaneously thanks to digital technology: automation and globalization. Because it is so important to look at them together, I call it “globotics”, an ugly but memorable word. It’s the subject of my book, The Globotics Upheaval: Globalization, Robotics and the Future of Work.

Consider for a moment: why is it cheaper to produce your goods in China? Are robots cheaper? No, it’s labor. Now, digital technology is automating the labor out of manufacturing, which is decreasing the cost differences between countries. When those cost differences become narrow enough, it will become easier for manufacturing to be localized. This is not about reshoring; it is about producing goods closer to customers.

At present, service exports are dominated by high-wage nations, but low wage nation exports have been growing faster since 2016. In 2021, based on data from the World Trade Organization, two thirds (64%) of the world’s services were exported from rich countries, while China exported about 5%, India 5% and the rest of the world 26%. Now, emerging market economy exports are growing faster than those of developed countries.

It’s important to note that “services” no longer just means final services, such as architecture or medical services. It means intermediate services – all of the back-office services that go into those final services. If you’re running a business, you already buy many services from other businesses – and it’s these B2B services – HR, accounting, bookkeeping – that are the future of trade.

Now consider the demand and supply. The demand for these intermediate services is huge in rich nations. 30% of all gross spending in wealthy nations is on intermediate services. Why? Because you need intermediate services to run every single business. You need it in mining, manufacturing and agriculture, but especially in services, which account for two thirds or three quarters of the whole economy.

What’s notable is that the supply of workers is huge in emerging markets, and they are already doing back office and accounting services for their own companies. North-north trade dominates intermediate services still, but non-OECD exports are growing twice as fast since 1995.

So, the good news is that the emerging market miracle will continue and spread but be based on services rather than industry and commodities. Countries all around the world that have talented low wage workers will now participate in exporting services and this will be extraordinary. Just think about how this could transform cities like Nairobi, Bogota and Buenos Aires.

“The emerging market miracle will continue and spread but be based on services rather than industry and commodities.”

These are the five reasons why intermediate services trade will continue grow faster for decades:

What we will see therefore in the emerging markets is hundreds of millions of people getting richer. And in developed countries, your virtual offices will be filled with ‘telemigrants’. The bad news, of course, is that this will likely foster a backlash against globalization in high-wage nations.

When humans think about progress, they fail to anticipate how fast things can change because we evolved in a walking distance world. It’s natural to think about what’s going to happen next year based on what’s happened over the last year. But that’s not how digital technology advances. AI is changing everything at breakneck speed because machine learning just needs data and then it starts to think for itself. Humans no longer need to program in sequential code, step-by-step instructions. Computers now have cognitive skills of their own.

What humans will end up doing is what telemigrants and AI can’t – jobs that are local and jobs that are human. I am optimistic that we are moving towards a richer and more generous society if we manage to transition well. As has often been remarked, the future is unknowable, but also inevitable. All we can assume is that it will not be the same as the present

Now is the time to decide what the future will hold for you, your families, and your companies. Because if you don’t, you won’t be ready to make the most of the opportunities that unfold.

This article is inspired by a keynote session at IMD’s signature Orchestrating Winning Performance program, which brings together executives from diverse sectors and geographies for a week of intense learning and sharing with IMD faculty and business experts.

Professor of International Economics at IMD

Richard Baldwin is Professor of International Economics at IMD and Editor-in-Chief of VoxEU.org since he founded it in June 2007. He was President/Director of CEPR (2014-2018), a visiting professor at many universities, including MIT, Oxford, and EPFL, and a long-time professor of international economics at the Graduate Institute in Geneva. Richard is an expert in global economic policy and theory, specializing in international trade.

July 10, 2025 • by Bruno Le Maire in Geopolitics

Former French finance minister Bruno Le Maire says Europe needs to act urgently to secure its supply of semiconductors or face relegation to the global slow lane. ...

Audio available

Audio available

July 8, 2025 • by Mike Rosenberg in Geopolitics

A new framework encourages leaders to see the world as PLUTO – polarized, liquid, unilateral, tense, and omnirelational. It’s time to think differently and embrace stakeholder capitalism....

Audio available

Audio available

July 7, 2025 • by Richard Baldwin in Geopolitics

The mid-year economic outlook: How to read the first two quarters of Trump...

July 1, 2025 • by Mridul Kumar in Geopolitics

Mridul Kumar, India’s ambassador to Switzerland, gives his personal view of his nation’s growing role as a leader in a multipolar world....

Audio available

Audio availableExplore first person business intelligence from top minds curated for a global executive audience