“We were so scared of our IPO”: Leaders Unplugged with former On-CEO Marc Maurer

Marc Maurer shares how ON grew from startup to IPO by defying hype, focusing on purpose, and leading with humility in this candid Leaders Unplugged episode....

by Niccolò Pisani Published July 21, 2023 in Strategy • 6 min read

India is Number One. The South Asian country has surpassed China to become the world’s most populous country, according to UN population projections announced in April 2023. This news marked a major milestone in world history. According to the UN projections, India’s population is now over 1.4bn and is projected to continue to grow for several decades. With 68% of India’s population between the working ages of 15 to 64 years old, the country has an abundant labor supply and potential for economic growth.

That potential is further upside over an already large base. According to the IMF, India has the fifth largest share of the world’s nominal GDP, with its US$3.74tn economy. In terms of GDP based on purchasing power parity (a more stable measure of value), India holds the third largest share of the world’s GDP. Despite recent turbulence in the global economic, financial, and political landscapes, India has demonstrated its resilience with a forecasted growth rate of 5.9% in 2023.

So why isn’t everyone already lined up to invest in this growing nation? The short answer is that certain challenges complicate matters for foreign businesses wanting to enter or expand in India. For instance, recent protectionist policies may hold back international business opportunities. Building on the latest data and research on India’s economy, here is my analysis of four key challenges impacting India’s growth trajectory going forward.

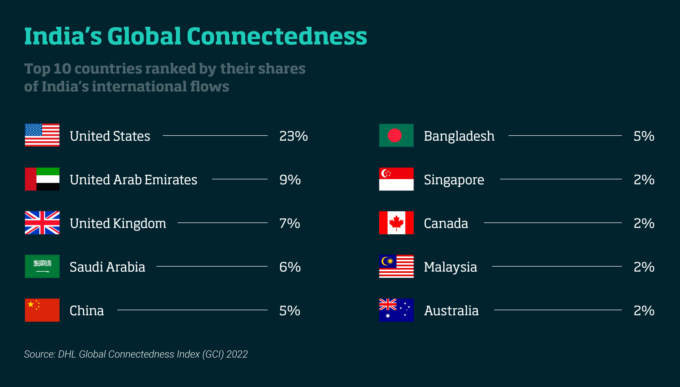

International connectedness is a key theme that will define India’s growth trajectory in a world that is likely to see more global fragmentation going forward. The latest DHL Global Connectedness Index (GCI), published November 2022 in partnership with New York University (NYU) Stern School of Business, measures international flows in trade, capital, information, and people for 171 countries. As per the GCI report, the top three connected economies in 2021 were the Netherlands, Singapore, and Belgium, while India secured the 67th position, above the average but below most economies of its size. Moreover, countries accounting for a total of 50% international flows for India included the United States, United Arab Emirates, United Kingdom, Saudi Arabia, and China – a diverse group of partners.

Here is a piece of advice for businesses in the European Union and in Latin America: To access Indian potential, build bridges where you can. International flows with India are currently limited in these regions (see their relative weight in the table), consider approaching India via its top connections, like the United States.

Remember that while India is more globally connected than it used to be (moving up two rungs in the ranking over the past two years), and its international flows are distributed across various countries, its international flows still account for a relatively small proportion of its total economic activity.

One important element of international connectedness is trade. Rising geopolitical turbulence is prompting trade restrictions that have impacted flows of goods and services, and countries – including India – are being challenged by this trend. The World Trade Organization (WTO) is among the organizations positing that trade restrictions have increased recently due to economic uncertainty caused by the COVID-19 pandemic and the war in Ukraine as well as food security crises.

In terms of international trade, Global Trade Alert’s data shows that protectionist measures have been inching up since its baseline year of 2008, with a pronounced recent surge starting in 2019. Again, India is on trend; as data shows, the country has also been implementing more protectionist than liberalizing measures in the last few years.

That said, the government of India has also adopted measures to encourage foreign trade, such as the Foreign Trade Policy (FTP) 2023, focused on facilitating export permits, increasing exports at grassroots level, and encouraging cross-border trade. To do this, India has also sought to sign free trade deals, most recently with Australia, the United Arab Emirates, and Mauritius. While the problem is that protectionist measures are still outnumbering the liberalizing ones, savvy businesses should seek out opportunities where India is opening up and leverage recently signed free trade deals to explore new pathways to enter the country.

India’s growth in the coming years will be defined by another important theme – digital. The IMD World Digital Competitiveness Ranking evaluates countries based on their digital infrastructure and capabilities, assessing them on the following factors: “future readiness, knowledge, and technology.” As per the 2023 report, India has slipped a few spots to rank 40th out of 64 nations (down from 37th in 2022). The report lists two of India’s main challenges in 2023 as accelerating its digital transformation and mobilizing its resources for infrastructure development.

While challenges remain, some key features such as international connectivity, trade-related interventions, digital transformation, and sustainability are set to shape India's growth story going forward and offer great opportunities to foreign investors that are ready to bet on the Indian market.

That said, a working paper published by IMF in March 2023 commends India’s recent efforts in developing digital public infrastructure, with widespread adoption of digital payments, data-sharing infrastructures, and e-commerce growth, among others. While this has mainly empowered domestic micro-, small- and medium-sized enterprises, it holds immense potential for future innovation and international business.

Another bright spot: India is home to multiple IT and tech companies, with an increasing focus on digital transformation and innovation. Infosys is one such example. The company recently signed large digital transformation deals with global companies such as Danske Bank and British Petroleum (bp).

India assumed G20 presidency for 2023 and one of its key priorities has been its clean energy transition. This is key for the world’s third largest greenhouse gas emitter (behind only China and the United States).

Renewable energy in India shows great potential for investors. Think of India’s scale. The nation reportedly had over 165 gigawatts (GW) of total installed renewable capacity by February 2023, which is forecasted to almost double by 2027.

One of the prominent renewable-energy companies in India that has attracted international investment is ReNew Power, with an aggregate capacity of 13.4 GW as of November 2022. Some of ReNew Power’s investors include Goldman Sachs, Canada Pension Plan Investment Board (CPPIB), Abu Dhabi Investment Authority, and Global Environment Fund (GEF).

At the end of the day, as the most populated country in the world, India holds great potential for domestic as well as international companies. While challenges remain, some key features such as international connectivity, trade-related interventions, digital transformation, and sustainability are set to shape India’s growth story going forward and offer great opportunities to foreign investors that are ready to bet on the Indian market.

IMD Professor of Strategy and International Business

Niccolò Pisani is Professor of Strategy and International Business at IMD. His areas of expertise include strategy design and execution as well as international business, with an emphasis on globalization and sustainability. His award-winning research has appeared in the world’s leading academic journals and extensively covered in the media. His work has been featured in both Harvard Business Review and MIT Sloan Management Review. He has also written several popular case studies that are distributed on a global scale.

2 hours ago • by Alyson Meister, Marc Maurer in Leadership

Marc Maurer shares how ON grew from startup to IPO by defying hype, focusing on purpose, and leading with humility in this candid Leaders Unplugged episode....

July 7, 2025 • by Richard Baldwin in Leadership

The mid-year economic outlook: How to read the first two quarters of Trump...

July 4, 2025 • by Arturo Pasquel in Leadership

Susanne Hundsbæk-Pedersen, Global Head of Pharma Technical Operations at Roche, shares how she has navigated the various pivots in her career, and the importance of curiosity, optimism and energy. ...

July 3, 2025 • by Eric Quintane in Leadership

Entrepreneurial talent who work with other teams often run into trouble with their managers. Here are ways to get the most out of your ‘boundary spanners’...

Audio available

Audio availableExplore first person business intelligence from top minds curated for a global executive audience