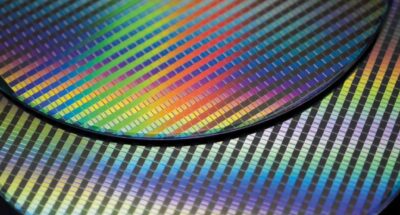

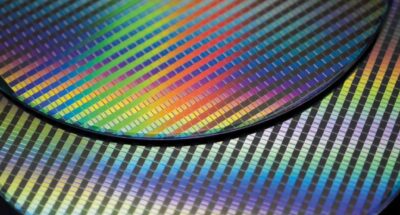

Europe needs Chips Act 2.0 to compete in digital race

Former French finance minister Bruno Le Maire says Europe needs to act urgently to secure its supply of semiconductors or face relegation to the global slow lane. ...

Audio available

by Richard Baldwin Published November 6, 2024 in Geopolitics • 4 min read

Donald Trump has been elected President of the United States in a historic comeback. His party will control the Senate and likely the lower house as well. It is too early to share fully joined-up thinking about the implications, but a few things are clear.

The Trump victory and sweep of the two houses of Congress will have massive effects inside America. The majority of what he talked about during his campaign were domestic matters, so I will not comment on those. When it comes to the rest of the world, the changes could be massive but are probably less unpredictable than the domestic implications.

After all, we have already seen the pilot episode of this series. We saw how Trump 2016-2020 dealt with international business, with trade policies, and with America’s traditional allies and adversaries. It was shocking and unexpected back then, as many failed to take him at his word while he was campaigning. It will be shocking this time, too, but it shouldn’t be unexpected. He will do what he said he would. We should all expect more of the same. But remember that he is not dogmatic. He is pragmatic, and he is supremely interested in his image, so he’ll only implement the international policy that boosts his self-perceived stature.

Let’s review what he said he’d do when it comes to international economic policy.

Trump wants to impose lots of tariffs on all US trade partners – and especially on China. The US-China story may get more intense, but the plotline won’t change. My prediction is that tariffs will lead to retaliation until the two sides do a ‘managed trade deal’ to stop the escalation. It is easy to see the trigger.

When the inevitable price shock shows up in Walmart and all those swing voters see their purchasing power plummet, he will back off and do a deal with China. For example, the last time he was in power, he exempted some key consumer goods from China to avoid the price shock it would have created. Remember, it is not important how many times Trump says tariffs don’t raise prices, because they do. The price rises from his last tariff tirade have been thoroughly documented.

“US citizens don’t have a standardized form of documentation to prove they are citizens. It is the birth certificate issued by a hospital that counts. ”

Likewise, if he follows through on his deportation pledge, he’ll immediately come up against a hard fact. US citizens don’t have a standardized form of documentation to prove they are citizens. It is the birth certificate issued by a hospital that counts. Immigration agents will inevitably rely on skin color and accents. However, since many American citizens have non-white skin colors and accents, a massive stop-and-ask procedure will lead to a backlash. Trump, who loves to be loved, will back off and refine. Remember his promise to “build a wall and make Mexico pay for it?” When the budget realities hit him, he let his promise slide off into oblivion. His promises on deportation will be something like that, in my view.

Europe's dealings with China will involve more than trade this time.

While China will probably see more of the same, Europe may be in for a rougher ride since the realities of 2024 are not those of 2016-2020. There is combat in Europe. Tanks are trying to change national borders. Thousands die every day. Russia feels empowered and has gained important support from China and troops from North Korea. None of that seemed reasonable in 2016. Now, it’s a reality.

What this means is that a fractured NATO, or a NATO without the US, would have far greater consequences for Europe. It would encourage even more military action by Russia.

Moreover, Chinese manufacturing is now a much more serious challenge to European industry than it was in 2016-2020. Take autos, for example. It is possible that Chinese exports to Europe seriously undermine production in Europe. As the US closes to Chinese goods, those goods will start to show up in Europe at cheaper prices. And that will lead the EU to put up barriers that will lead to Chinese retaliation.

While Trump has experience in this sort of cycle with the Chinese, Europe does not. We can hope the EU would be a fast learner, but as the EU is no one body politic, that learning could be messy and slow. It does not help that China has become noticeably more aggressive in international affairs in the South China Sea. If the Chinese dragon had started taking off its panda costume in 2016, now the dragon has fully emerged. This means that Europe’s dealings with China will involve more than trade this time.

Professor of International Economics at IMD

Richard Baldwin is Professor of International Economics at IMD and Editor-in-Chief of VoxEU.org since he founded it in June 2007. He was President/Director of CEPR (2014-2018), a visiting professor at many universities, including MIT, Oxford, and EPFL, and a long-time professor of international economics at the Graduate Institute in Geneva. Richard is an expert in global economic policy and theory, specializing in international trade.

July 10, 2025 • by Bruno Le Maire in Geopolitics

Former French finance minister Bruno Le Maire says Europe needs to act urgently to secure its supply of semiconductors or face relegation to the global slow lane. ...

Audio available

Audio available

July 8, 2025 • by Mike Rosenberg in Geopolitics

A new framework encourages leaders to see the world as PLUTO – polarized, liquid, unilateral, tense, and omnirelational. It’s time to think differently and embrace stakeholder capitalism....

Audio available

Audio available

July 7, 2025 • by Richard Baldwin in Geopolitics

The mid-year economic outlook: How to read the first two quarters of Trump...

July 1, 2025 • by Mridul Kumar in Geopolitics

Mridul Kumar, India’s ambassador to Switzerland, gives his personal view of his nation’s growing role as a leader in a multipolar world....

Audio available

Audio availableExplore first person business intelligence from top minds curated for a global executive audience