During the Cold War, geopolitics was like checkers with two players and simple rules. The game was so straightforward that almost every match ended in a draw. Some countries stood behind the eastern player, the Soviets, while others supported the western player, led by the US. They were two worlds with their own rules, banking systems, supply chains, and economic philosophies.

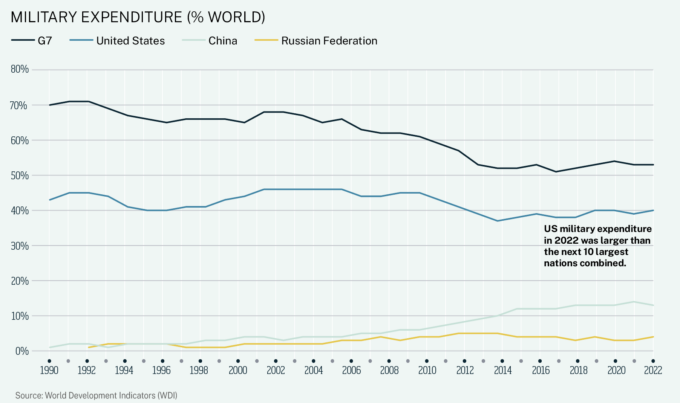

The Soviet Union’s collapse triggered a new phase of geopolitics that was more like bingo. One main player (the US) called out the numbers while everyone else sat with their bingo cards, trying their best. Some won, others didn’t. Many people didn’t like the game but could do little about it. The US dominated almost every sphere: economic, military, security, intelligence, cultural, and financial. The dollar was the linchpin of the world financial system.

Today, it’s a lot more complicated. The game has become something akin to 3D chess with about 150 players at the table: some play when the pieces are on the top plane, some when they’re on the bottom plane, others all the time, and some never play. The rules are unclear, in flux, and different for different regions and domains. The global landscape has never been more confusing and challenging to navigate.

To understand why this is happening and how businesses might respond, it helps to consider what has been driving these changes. Spoiler alert: it’s not just President Donald Trump.

1. G7 global economic clout diminished

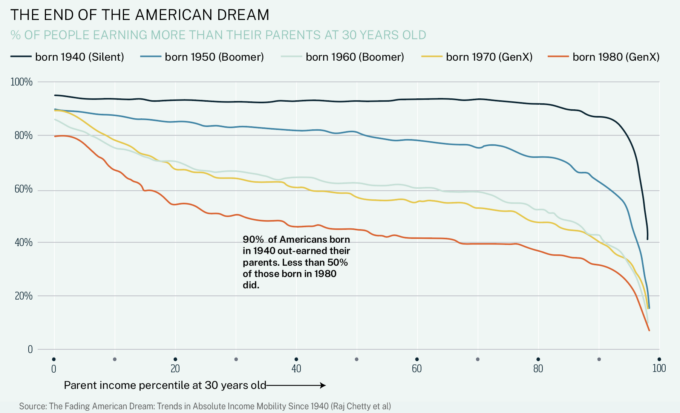

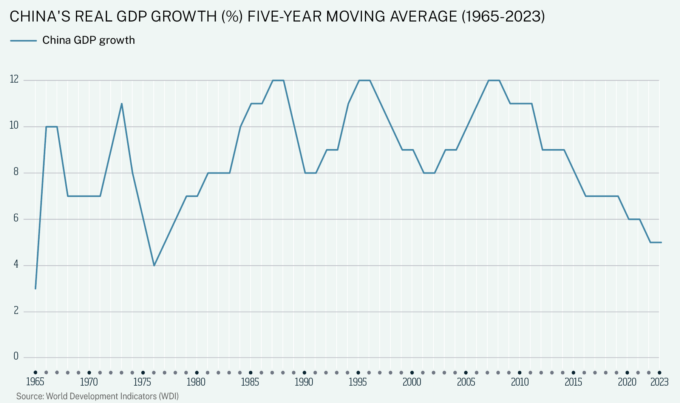

In 1990, the G7 industrialized countries controlled about two-thirds of world GDP and all the rules, institutions, and systems that went with it, with the US as leader. Fast forward to 2022, and the G7’s share of global GDP had plummeted to just 44%. While the US share has held steady at around 25%, other G7 members saw their GDP shares drop. Meanwhile, China experienced a miraculous rise from 2% to 17%. While impressive, this isn’t enough for dominance. Even when China eventually surpasses the US economy, it won’t achieve the dominance the G7 once enjoyed. For starters, it doesn’t have a coalition of massive economies following its lead.

These shifting sands have played out in market influence. In 2001, more countries counted the US as their largest market compared with China. However, by 2018, China had become the dominant buyer for many nations. This shift reflects China’s waxing and America’s waning leverage.

Audio available

Audio available

Audio available