IMD business school for management and leadership courses

By Howard Yu and the Center for Future Readiness

Future Readiness Indicator

By Howard Yu and the Center for Future Readiness

Finance Future Readiness Indicator 2023

Who is leading the charge toward a future-ready finance landscape? IMD reveals the answer through an insightful case study analysis. Hint: Mastercard.

In the finance world —constantly influenced by technology advancements and dynamic market changes—the concept of future readiness has emerged as a key to success.

This idea represents a finance organization’s ability to forecast and quickly adapt, leveraging artificial intelligence (AI), data analytics, and machine learning for enhanced decision-making and performance management.

The financial services sector is experiencing a significant shift, driven by the need for sustainable practices, robust risk management, efficient supply chain management, and Environmental, Social, and Governance (ESG) considerations, all accelerated by the pandemic’s impact.

IMD’s Future Readiness Indicator sheds light on this evolution, highlighting how leading finance organizations, including financial giants like Mastercard, aren’t just surviving but thriving by transforming their operating models.

These organizations are integrating automation and real-time analytics into their finance functions, transforming back-office operations to align more closely with strategic business decisions.

However, as the early 2023 bank collapses from Silicon Valley to Switzerland illustrate, being future-ready isn’t solely about embracing the latest technological advancements. It also involves a strong focus on business fundamentals, ensuring innovation is balanced with stability.

What makes finance companies future-ready?

A future-ready finance company is one that’s up to date with technology and prepared for tomorrow’s financial landscape.

These companies typically invest heavily in digital tools, like financial technology (fintech), to make their operations more efficient and improve customer service. They use things like advanced data analytics, AI, and blockchain to provide new and better services, handle transactions securely, and offer customers personalized financial advice.

Future-ready finance companies also focus on being sustainable and ethical. They make investment choices that consider ESG factors. This approach not only meets global sustainability goals but also attracts customers who care about these issues.

Being adaptable is also key for these companies. They’re quick to adjust to new regulations and market changes, making sure they’re always ready for whatever the financial world brings next.

Global finance organization rankings

IMD’s Center for Future Readiness tracks which companies are the most future-ready through objective, rule-based measures calculated as a composite score.

Below are our 2023 rankings for financial services companies.

Click on the company’s name to see details of the score, and drag the slider to adjust the year.

Mastercard

Mastercard stands at the forefront of future readiness in the financial services industry, earning its place in the Finance Future Readiness Indicator 2023.

The company’s top position is attributed to its innovative approach to digital payments and a strong commitment to integrating advanced technologies like AI and data analytics into its operations. Mastercard has shown remarkable resilience in navigating market disruptions, evident in its sustained profitability and growth.

The company’s rapid adaptation to changing market needs, especially in the realm of digital and contactless payments accelerated by the pandemic, highlights its innovative spirit. Mastercard’s focus on security and customer convenience, through features like biometric verification and enhanced fraud protection, reinforces its commitment to customer satisfaction and trust.

Moreover, Mastercard’s global impact is significant, with strategic expansions and partnerships across diverse markets. These efforts demonstrate an understanding of varied consumer behaviors and show a commitment to financial inclusivity and sustainability, aligning with global ESG goals.

Visa

Visa has secured a top position in the Finance Future Readiness Indicator 2023, reflecting its role as a leader in the evolving world of financial services.

Visa’s success is largely due to its cutting-edge approach to digital payments and a proactive stance on cybersecurity and data protection. The company has adeptly managed the challenges presented by the digital transformation of financial services, maintaining robust growth and operational efficiency.

Visa’s initiatives in advancing contactless and mobile payments have set new standards in the industry, providing seamless and secure transaction experiences for customers worldwide. The company’s investment in blockchain technology and partnerships in emerging markets underscore its commitment to innovation and global financial connectivity.

JP Morgan Chase & Company

JP Morgan Chase & Company has emerged as a leading entity, highlighting its adaptability and forward-thinking approach in the banking sector. The company’s embrace of digital transformation, especially in mobile banking and online financial services, has been pivotal in its success.

JP Morgan’s investment in AI and machine learning for risk management and customer service optimization represents a significant step toward a more efficient and customer-centric banking experience. The bank’s focus on sustainable finance and responsible investing aligns with the growing global emphasis on ESG principles, demonstrating a commitment to ethical and environmentally conscious business practices.

Additionally, JP Morgan’s ability to effectively navigate the financial challenges posed by the pandemic, along with its strategic initiatives in fintech collaborations and digital innovation, have played a crucial role in its achievement as a future-ready finance leader.

Historical comparison of top financial companies

At the Center for Future Readiness at IMD, we assess how well companies are equipped to handle future changes. Our method involves a quantitative approach, where we analyze solid market data to produce a comprehensive score.

We gather this data from various sources including the companies’ own websites, their annual reports, press releases, and relevant news articles.

Additionally, we enhance our analysis with information from external sources like Crunchbase, Espacenet, and Google Trends. For more details on our approach, you can read about our methodology.

Select top financial companies for historical comparison in the following line chart. Use the slider to adjust the years.

Important financial trends

Those who are future-ready have their activities more aligned with external trends. It’s because of such alignments that they can achieve greater success, regardless of the business cycle.

So, what were the most important trends in 2023, and how did the top-ranking companies align with them?

Disappearing boundary: The embedded revolution

Embedded finance is a fancy term that describes blending financial services into nonfinancial services, with banking, credit, and insurance all thrown in. One popular example is buy now pay later (BNPL), which lets you buy things at a local store and then pay for them over time.

The BNPL market is growing; some project it will reach nearly $4 trillion USD by 2030. That may be why Square decided to pay $29 billion USD to acquire Afterpay.

But the key to winning in embedded finance is an easy-to-use, all-in-one experience. Think about one-click shopping on Amazon, but now for everything you do every day.

Naturally, such “frictionless” experiences would need deep collaboration between banks, tech providers, and product distributors. Things like loyalty apps, digital wallets, and other online shopping platforms will talk to one another, with application programming interfaces (APIs) making all this work. These behind-the-scenes tools help different programs and organizations communicate.

Mastercard and Visa have been working on their API interfaces for decades. But this work is not just about tech solutions. Companies need to understand that whatever they create will never be enough. It’s also about letting outside parties, competitors or not, use what you have and improve on it to make something valuable for end users.

This is a tough sell for many old-school organizations, but companies like JP Morgan in the United States and DBS in Asia are nailing it. In contrast, European counterparts, known for their historical conservatism, may find this way of doing business too foreign and unnatural.

Making everything more personal: Open banking

One bright spot for European banks, however, is open banking. This concept has already been mandated by the government. Think of it as an open standard so that financial data is shared between banks and other services like apps.

In the past, big banks controlled all your financial data. With open banking, however, consumers can access their information on different platforms. You don’t even need to log into your bank account in the first place.

Popular financial apps like Robinhood, Chime, Mint, and Empower all rely on the concept of open banking. These apps help users organize and manage their money in one place, with personalized suggestions.

Again, APIs are what make all this possible. Once a third-party service is authorized to use your data, it can use it to offer tailored solutions. Open banking thus encourages creativity and competition, pushing banks to step up their game.

Interestingly, regulators pushed open banking in Europe, not entrepreneurial banking execs who decided to make it happen. But future-ready financial companies saw the bigger picture.

Instead of viewing open banking as just another compliance headache, they transformed their work on APIs into genuine business opportunities. Some even turned to banking software providers to create new tools.

As always, governments can only do so much. It’s up to the banking executives to seize their chances.

The key to future-ready success: Fast decision-making and a clear vision

To win in such a shifting landscape requires, at minimum, a strong vision for the future. Any players aiming to stay relevant need to invest significantly in new technologies. And the best companies are creating top-notch digital tools, advancing AI, and more.

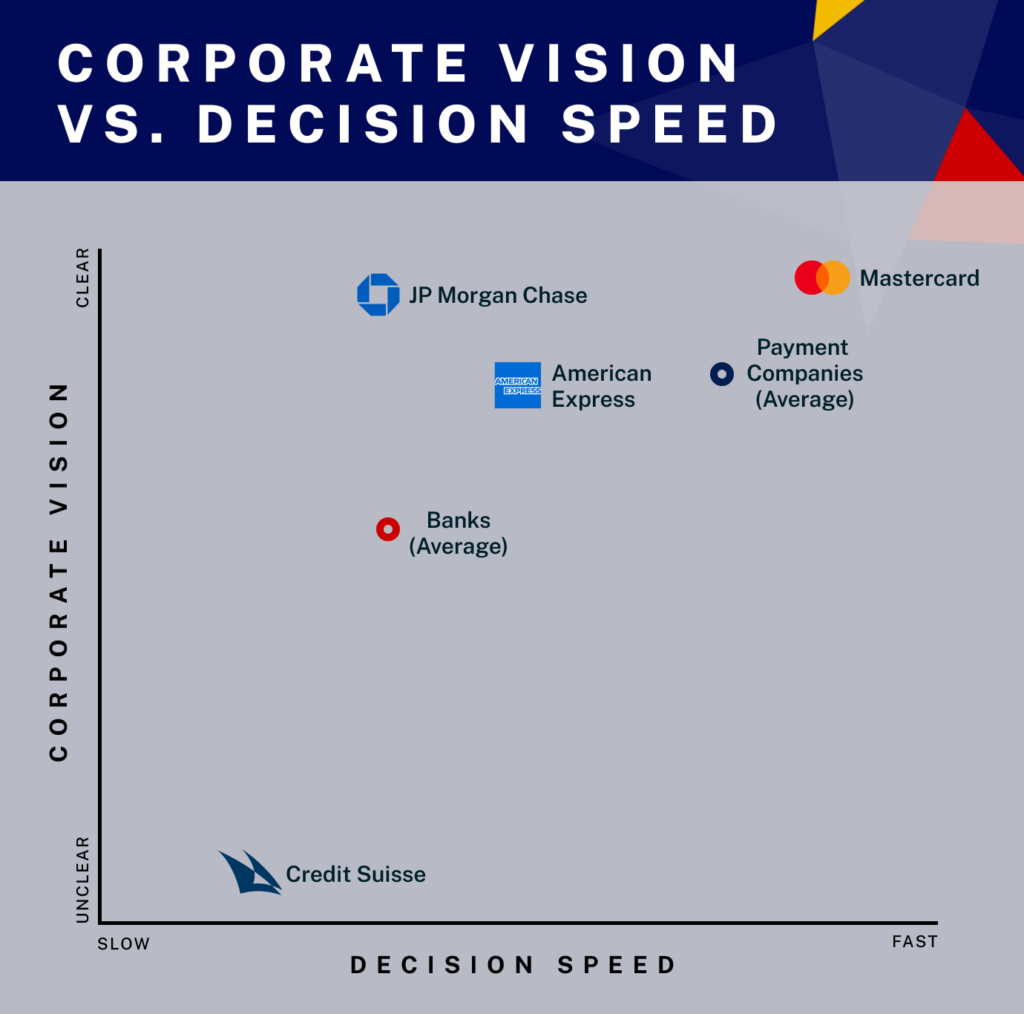

IMD built an AI tool that analyzes a decade of data from 60 news sources. We score companies’ personalities using natural language processing (NLP) by measuring two key aspects, as shown in the following chart.

The Y-axis reflects the speed at which companies make decisions, and the X-axis illustrates how well these companies articulate their vision.

What we see is indisputable. Top payment companies (e.g., Mastercard) are faster (in comparison to the industry average) in their decision-making. If something doesn’t work, you need to shut it down quickly and try a new approach.

Learn from failed experiments, pivot, and keep pushing forward. Concurrently, you must maintain a strong vision about why you are doing what you do. The same can be said about banks as well.

So, what’s the takeaway? Don’t be afraid to make tough decisions and remember that persistence pays off. To be future-ready, you must excel today while building tomorrow.