IMD business school for management and leadership courses

Published on November 21st, 2025

The Loop: How American Profits Built Chinese Power

Published on November 21st, 2025

The email lands at 6:04 a.m. The subject line reads, “Export License Pending.”

Somewhere in Beijing, a rubber stamp hovers. Somewhere in Ohio, a three-billion-dollar supply chain holds its breath. A turbine waits for its magnets. A factory idles. A launch date slips.

You’ve seen this movie before, yet the twist still surprises. Rare earths last week. Pharmaceutical ingredients a few months ago. Battery materials last quarter. Each headline feels like tugging a thread and watching the whole sweater come apart.

How did this happen? When will it stop?

It won’t stop. Not because of conspiracy or incompetence, but because two powerful systems are playing by different rules.

In America, the Religion of Profit sends capital sprinting toward margin, speed, and quarterly wins.

In China, the Cult of Scale and Sovereignty channels patient money into the unglamorous muscles of production: refineries, chemicals, tooling, and engineers.

Put those two systems together, and a four-step loop begins.

- We outsource the hard parts to hit short-term targets.

- We transfer knowledge to meet quality.

- Our demand pulls suppliers, mines, and talent into one geography.

- Then the control points solidify, and a single stamp can halt the world.

Bargain → Transfer → Gravity → Lock-In

This isn’t a conspiracy. It’s system behavior. And it all began the night a plastic iPhone screen got scratched in Steve Jobs’s pocket.

Where The Bargain Begins

The call came in at 3:00 a.m. California time. On the line was Jeff Williams, Apple’s head of operations. On the other side of the world, under a yellowed strip light in Shenzhen, sat Terry Gou, founder of Foxconn.

The iPhone prototype was beautiful until it wasn’t. A week in someone’s pocket, and the plastic screen was covered in scratches. Steve Jobs wanted glass. Thin. Hard. Flawless. Or the project was dead.

“Six months,” Williams says. “We need a miracle.”

What followed wasn’t a purchase order. It was an apprenticeship.

Foxconn switched to 24-hour shifts. Apple engineers flew in by the dozens, flooding the factory floor. They didn’t just hand over specifications. They taught, cajoled, argued, and demanded.

A misaligned screw? Stop the line. “Close enough”? Grounds for dismissal.

Out of that crucible came the unibody laptop, Gorilla Glass for the iPhone, and aluminum seams so perfect you could glide a fingernail across and feel nothing. It also produced a generation of Chinese factories fluent in manufacturing the impossible.

For local officials, it meant GDP and jobs. For workers, it meant a road from village to city.

That was Apple’s real secret sauce. Not design, not software, but a ruthless, precision-built operating system for manufacturing that captured 80 percent of global smartphone profits while suppliers like Foxconn scraped by on one or two.

Former employees still talk about the intensity. “The Apple guys would stand on the floor for 18-hour shifts,” one recalled. “We called them the quality demons. But we learned. God, did we learn.” Once you can build for Apple, everything else is easy.

For Wall Street and for America’s 401(k)s, it was a gold rush.

The Perfect Partnership (That Changed the World)

When Apple first shifted production to China in the early 2000s, neither Steve Jobs nor Beijing’s bureaucrats, grasped the long-term stakes. No one had connected the dots yet.

Provincial officials courted Apple and Foxconn with missionary zeal, because bringing jobs to their cities often meant promotions for them.

In one famous case, the city of Zhengzhou offered everything: tax breaks, free factory construction, worker housing, even airport expansion, all to win Apple’s contract.

The deal was irresistible. China offered armies of skilled, disciplined workers and local leaders who could fast-track any project. No protests. No delays. No lawsuits. The message from officials was simple: come to my city, and we’ll make you a success.

Before long, Apple had poured $275 billion into China. That’s an investment on the scale of the Marshall Plan, which rebuilt Europe after World War II. It helped train more than 28 million workers, a workforce larger than the entire state of California. It installed its most advanced machines inside Foxconn factories, tagged “For Apple Use Only.”

But Apple’s suppliers were willing to endure razor-thin margins for a different prize: knowledge. Once you could meet Apple’s impossible specifications, building for Xiaomi, Oppo, or Huawei felt effortless.

Grace Wang’s story tells it all.

- In 1988, she was a factory worker, soldering components for pennies an hour.

- By 2023, she was the CEO of Luxshare, one of Apple’s key suppliers. Her firm was handling “new product introduction,” the sacred process where prototypes become production.

When Tim Cook visited her factory in 2017, Wang told him:

Apple’s stringent requirements have profoundly impacted Luxshare. Over the years, we have closely followed Apple, and this alignment has propelled Luxshare toward growth and prosperity.

Translation: You taught us everything. Now we can use it for other companies.

The irony wasn’t lost on Apple’s own engineers. “We’ve trained a whole country and now that country is using it against us.”

How Elon Musk Became China’s Greatest Teacher

If Apple taught China over twenty years, Tesla hit fast‑forward.

In January 2019, Shanghai broke ground. By December, the first cars rolled off the line. Twelve months. That’s how long it took Tesla to go from empty marshland to employee deliveries in China.

In California, regulators were still arguing over parking lot permits for a factory that wouldn’t break ground for another four years.

The Chinese state rolled out unprecedented support for Elon Musk:

- $521 million in loans at 3.9% interest, far below market rates

- Another $1.4 billion line of credit

- A 50-year land lease for only $140 million

- A corporate tax rate of 15%, down from the usual 25%

- Most critically, Tesla was allowed to operate as China’s first wholly foreign-owned auto plant. No joint venture required.

Musk’s closest ally wasn’t in the White House. It was inside the Forbidden City in Beijing.

The transfer wasn’t just about electric vehicles. It was about the process. Tesla’s Gigacasting turned seventy parts into one. LK Group co-developed the presses. Within months, Chinese automakers were ordering the same machines, only bigger.

Next door, CATL built an entire battery city to supply Tesla. Then it supplied everyone else.

Michael Dunne, auto consultant and former GM executive in Asia, captured it best: “There’s the China before Tesla, and the China after Tesla. Tesla was the rainmaker.”

What Tesla also built, however, was gravity. That massive, predictable demand that pulled the entire upstream ecosystem into China’s orbit: cobalt, lithium, rare earths, and specialized chemicals.

Once you see it, you can’t unsee it. Every “shocking” headline is just the same movie, playing on repeat.

Bargain → Transfer → Gravity → Lock-In

Why We’re Surprised Every Single Day

Take lithium, the lifeblood of batteries. From the salt flats of South America to the mines of Australia, Chinese companies spent the late 2010s buying into projects that would power the future.

One common scene: a delegation of U.S. advisors lands in the Congo to survey a promising site, only to learn the rights to the next major cobalt deposit were sold three days earlier to a Chinese consortium. The ink was still wet.

By 2025, China refined nearly three-quarters of the world’s cobalt and more than half of its lithium.

Our dependency wasn’t an accident. It was the logical outcome of two systems playing by two different rulebooks. Each was winning the game it was playing.

How so?

The American Rulebook: The Religion of Profit

In the United States, capital behaves like a mercenary. It goes where the margins are fat and the assets are light. Wall Street worships scalability above all else. The “Magnificent Seven” tech giants have become the new American deities.

Why tie up billions in low-margin, polluting factories for rare-earth refining or chemical processing when you could pour that money into R&D, software, and marketing and earn a 40-percent return?

The system worked. It minted the most profitable companies in history, and we convinced ourselves our edge was innovation and software.

But the software still runs on hardware, and hardware begins in the dirt.

The Chinese Rulebook: The Cult of Scale and Sovereignty

China’s system runs on a different track. The currency for local officials isn’t profit; it’s GDP growth and jobs. A mayor’s path to promotion isn’t through a rising stock price. It’s through a new factory employing ten thousand people.

When a state-owned bank lends billions to build a rare-earth refinery, it isn’t calculating net present value. It’s following a directive. It’s creating jobs.

Profit margin is an afterthought.

That divergence became a fatal attraction. Those “afterthoughts” turned into the backbone of global manufacturing, one smelter at a time.

The West optimized for profit. China optimized for position.

The Choke Point Arrives

Rare earths. Seventeen ghost elements, invisible in magnets and motors, yet everywhere inside modern life. They make wind turbines spin, semiconductors compute, smartphones vibrate, and the F-35 fighter jet fly.

Rare earths aren’t rare; the willingness to refine them is. The work is filthy, the waste is toxic, and the permits are endless.

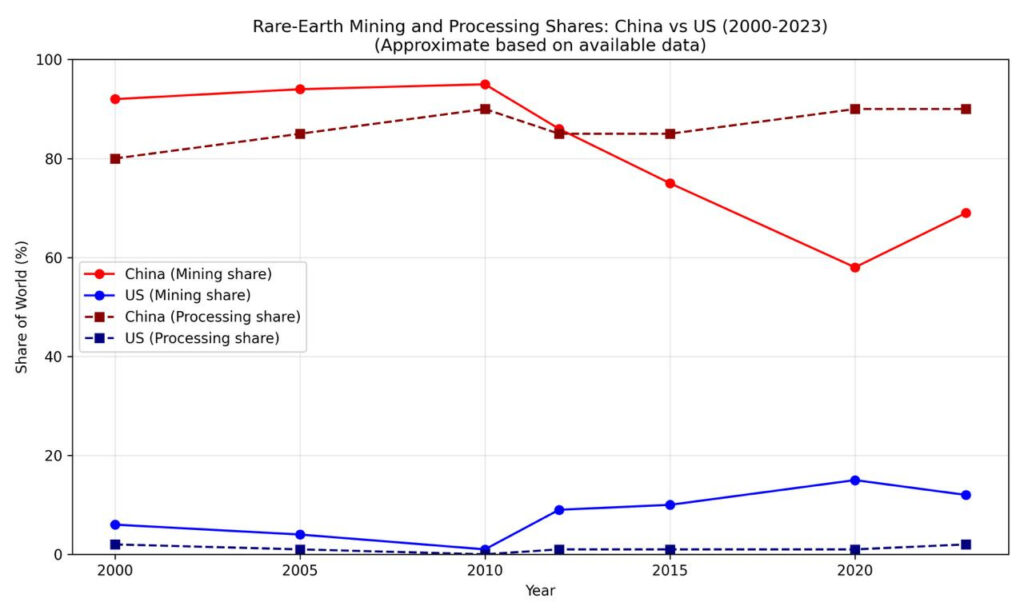

China played the long game. It pushed volume, subsidized prices, absorbed losses, and waited. Year after year, competitors shut down. Until one day, every critical processing step — all the irreplaceable ones — sat entirely at home.

That’s how China came to control over 70 percent of global rare-earth mining and over 90 percent of refining and separation. It also bears saying plainly: the world’s clean-tech boom was built on China doing the dirty work others refused to do. Everyone won, until Beijing decided it was payback time.

Now, any foreign company that needs these materials must first secure an export license from China’s Commerce Ministry. One rubber stamp can freeze a billion-dollar supply chain.

Who can blame them? Beijing learned this from Washington.

When the United States restricted Nvidia’s chips to China, it showed that supply chains could be turned into weapons. When the US dismissed the World Trade Organization as a paper tiger, China took note.

Pharma: The Same Pattern, on Double Speed

The pattern doesn’t stop at metals. It’s accelerating in medicine.

In the first half of 2025 alone, Western drugmakers signed $48.5 billion in partnerships with Chinese firms, eclipsing the total for last year. Clinical trials cost 30–40 percent less. Patient enrollment is two to three times faster.

Beijing cleared red tape so thoroughly that the time for foreign-approved drugs to reach Chinese patients has fallen from 85 months to under 30.

At the center stands WuXi AppTec, known in the industry as pharma’s Foxconn.

WuXi’s model is simple but radical. As a Contract Research, Development, and Manufacturing Organization (CRDMO), it lets global pharma outsource everything from molecule design to mass production under one roof.

The scale is staggering. Nearly 6,000 partners across more than 30 countries, a pipeline of 3,393 molecules in motion, and full FDA compliance.

For Western pharma facing patent cliffs that threaten $183.5 billion in lost revenue by 2030, those savings aren’t optional. They’re survival.

But the dependency runs deeper still. China now produces about 40 percent of the world’s supply of generic APIs, the active pharmaceutical ingredients inside most medicines. The details are stark: ibuprofen, 90 to 95 percent; acetaminophen, 70 percent; key antibiotics, over 80 percent.

Even India, often seen as the alternative, imports 70 percent of its APIs from China, worth roughly $2.5 billion each year.

No industry is immune. The gravitational pull of China’s ecosystem is too strong. The cycle sustains itself.

The Three Laws of Strategic Rivalry

So where does this leave us? Reversing the current dependency will take decades. The hardest barrier isn’t technology or capital. It’s the loss of entire ecosystems in the West.

Apple couldn’t build an iPhone in America today. It’s not about the 700,000 factory workers. Those could be hired if politics allowed. It’s about the 30,000 manufacturing engineers behind them and the supplier network that synchronizes every delivery.

China compressed thirty years of automotive learning into ten for electric vehicles, only because Tesla was there to teach it.

Who teaches America now, when the knowledge lives in China?

The headlines will keep coming. Each new shock will feel sudden. But strip away the noise, and three principles emerge. These are the laws that govern strategic rivalry.

Law #1: To Fight a Rival, Understand Their Scorecard

You can’t outplay a rival if you misread their objective function. Profit is Wall Street’s scoreboard. Sovereignty is Beijing’s.

Your First Takeaway: In any conflict — business, politics, or career — never assume the other side is keeping score by your rules. Ask yourself: What does their win look like? Is it money, prestige, security, or stability? You can’t outplay an opponent you don’t understand.

Law #2: The Long Game Always Beats the Short Game

Ninety-day earnings vs. five-year plans. You don’t rebuild upstream in a quarter. The side that plans in decades will own the choke points.

Your Second Takeaway: Stop optimizing for the next quarter. Whether it’s your career, your investments, or your health, commit part of your energy to what pays off in five, ten, or twenty years. Plant trees you may never sit under.

Law #3: Never Wake a Sleeping Giant Unless You Are Ready to Fight to the End

For decades, the U.S.–China relationship was symbiotic. American companies gained profits; China gained jobs. Then came the export controls on chips and the blacklisting of Huawei. That was the moment the bear was poked.

Beijing jolted awake. What followed was an all-out, no-expense-spared drive for technological self-sufficiency. Napoleon once warned, “Let China sleep, for when she wakes, she will shake the world.”

Your Third Takeaway: Don’t declare war on a problem you aren’t ready to see through. Don’t signal confrontation unless you can win the fight that follows. Sometimes quiet preparation is the strongest form of strength.

The three laws apply whether you’re running a company, shaping policy, or simply trying to understand how competition really works.

The World We’ve Built

The West built speed by borrowing muscle. Now the bill is coming due.

The sleek device in your hand, the electric vehicle on the road, and the life-saving medicine in your cabinet were all born of the same bargain.

Bargain → Transfer → Gravity → Lock-in

It began with a scratch in a pocket; it ends with a stamp on a desk. The loop doesn’t break. It only tightens.

Reversing it means lower profits, longer timelines, and rewriting the scorecard our retirement funds depend on. The first lesson in this new, more dangerous world is simple: understand the rules that hold it together.

Only then can we stop asking why it keeps happening again.