IMD and Swiss Ventures Group (SWVG) have created a dedicated annual executive education program for experienced investment professionals to improve understanding of the venture capital market, supported by the creation of a dedicated center for venture asset management competence.

The program, which launches in 2023 and will be hosted at IMD’s Lausanne campus, will involve a two-day, in-person course for institutional investors focusing on educating finance professionals, and developing a community and platform for peer exchange in Europe.

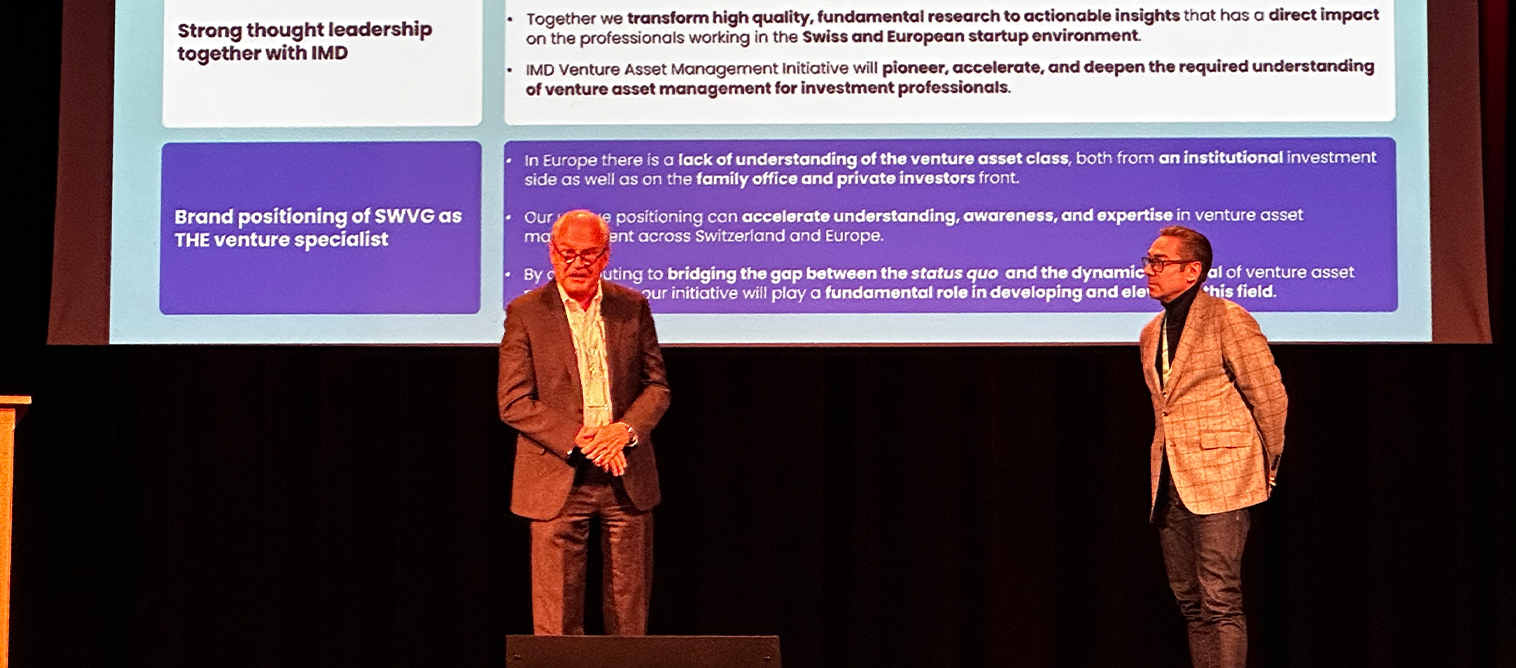

Partnering with SWVG, a privately funded group that has become one of the most active early-stage investors in Switzerland, IMD has founded the Venture Asset Management Competence Center as an innovation hub to create valuable academic research and support the new initiative.

As many European investors – whether from professional, family office, or private origin – are unfamiliar with venture capital market mechanisms, dedicated experts from the field will provide insights into the latest research. Participants on the course can expect to gain high quality and actionable insights that will have a direct impact on their interactions with the Swiss and European start-up environments.

Michel Demaré, Chairman of IMD’s Foundation and Supervisory boards, and a start-up investor, said: “There is enough innovation and creativity in Switzerland and Europe to compete with other countries in terms of quality of start-ups. Where we lag behind is in the area of funding capabilities. European risk capital is scarcer, there is less risk taking, and we hope through this project to promote venture capital as a new asset class in Europe.”

“With this new collaboration, IMD can demonstrate its unique expertise in the start-up area and offer interested parties the opportunity to broaden their knowledge basis around start-ups, understand their requirements, and anticipate their needs.”

Karl Schmedders, Professor for Finance at IMD, said: “I am looking forward to passing on our academic knowledge, together with the practical experience of the SWVG, to our graduates of the new course. It is certainly very, very exciting.”

SWVG CEO Mike Baur said: “This unique collaboration will accelerate the understanding, awareness, and expertise in venture asset management across Switzerland and Europe. With our unique professional network, we will support bridging the gap between the status quo and the dynamic potential of venture asset management. It is my fundamental belief that our initiative will play a fundamental role in developing and elevating this field.”