Healthcare is entering a new era, one where artificial intelligence works quietly in the background, amplifying clinicians’ abilities much like a stethoscope amplifies a heartbeat. Across the industry, AI solutions are becoming the partners of doctors, nurses, and researchers, transforming care delivery from diagnostics to daily operations.

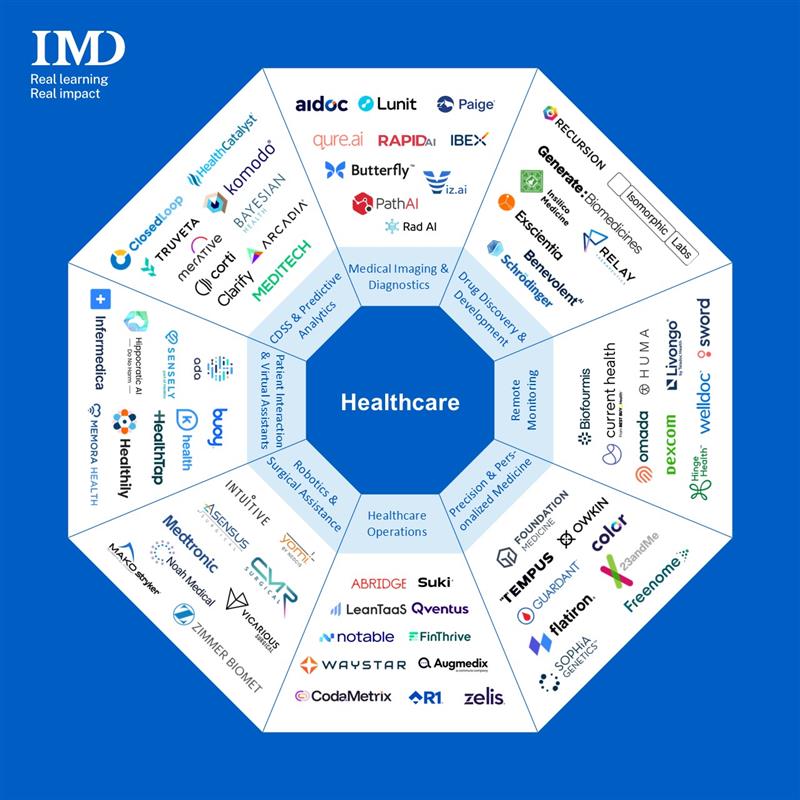

In this overview, we explore eight key areas where AI is reshaping healthcare: Medical Imaging & Diagnostics, Drug Discovery & Development, Remote Monitoring & Chronic Disease Management, Precision & Personalized Medicine, Healthcare Operations & Workflow, Medical Robotics & Surgical Assistance, Patient Interaction & Virtual Assistants and Clinical Decision Support & Predictive Analytics. In each, startups (and a few big tech players) are deploying smart tools that speed up care and reduce errors, often while clinicians focus on human touch. Below we explore each domain’s leading trends and products.

1. Medical Imaging & Diagnostics

Radiology is the poster child for AI in care. With radiologists in short supply, AI is being pressed into service to read scans faster and catch subtle findings. Market research firm Signify predicts that radiology teams will lean on generative AI to summarize cases and integrate data from records. In practice, today’s startups are providing second eyes for clinicians. For example, Aidoc has developed dozens of FDA-cleared algorithms that analyze CTs and X-rays for critical pathologies – its AI has already reviewed millions of scans, triggering alerts that saved providers nearly 70 million minutes of review time. Similarly, PathAI enhances pathology diagnosis through machine learning while Lunit specializes in cancer detection through AI analysis of mammograms and chest radiographs. In stroke care, Viz.ai uses deep learning to detect large-vessel occlusions; its flagship Viz.ai One can integrate with hospital systems to detect and triage a variety of time-sensitive conditions. These AI tools act as low-key partners, automating routine reads and surfacing red-flag cases so radiologists can focus their expertise where it matters most.

| Tool | Primary Use | Ease of Use | Pricing | Best For | Output Quality |

|---|---|---|---|---|---|

| Aidoc | AI triage of critical CT/MRI findings | Moderate (PACS plugin) | Volume-based | Hospital radiology workflows | High (FDA-cleared, real-time alerts) |

| Viz.ai | Stroke and neuro critical care coordination | Moderate (requires installation) | Subscription/enterprise | Stroke teams (ER to IR) | High (Clinical validation) |

| PathAI | Pathology diagnosis enhancement | Moderate (cloud-based) | Enterprise | Pathology labs, pharma | High (Research-grade) |

2. Drug Discovery & Development

Pharma R&D is being turbocharged by AI: a recent report valued it at $1.7B in 2024 with a projection to $8.5B by 2030, a CAGR of over 30%. The key trend is generative modeling or using deep learning to propose and evaluate novel molecules in silico. Google/DeepMind’s recent AlphaFold 3 breakthrough is emblematic: it can now predict protein structures and even protein–ligand interactions with 50%+ better accuracy than before. Startups are wielding generative algorithms to dramatically cut timelines.

For instance, UK-based Exscientia created the world’s first AI-designed molecule for immuno-oncology to enter human clinical trials in just one year after project start, which is far faster than the typical multi-year process. Recursion (US-based) uses AI on billions of cell images to find new indications. Last year, these two market leaders formed a collaboration to accelerate technology-enabled drug discovery. Hong Kong’s Insilico Medicine (and its platform Pharma.AI) used its chemistry-generating engine to find a “first-in-class” candidate against an otherwise “undruggable” cancer target in partnership with large pharmaceuticals like Sanofi. In short, AI is the lab assistant that never sleeps: it sifts through bio-data to identify targets, generates molecule libraries, and predicts the best candidates for preclinical tests.

| Tool | Primary Use | Ease of Use | Pricing | Best For | Output Quality |

|---|---|---|---|---|---|

| Exscientia | Generative AI molecular design | Platform/API (for pharma partners) | Enterprise (project-based) | Biotechs, big pharma R&D | High (clinically validated candidates) |

| Insilico Medicine | Generative biology for target/lead discovery | Cloud platform (collaborative) | Upfront license/collaborations | Drug companies, biotech | High (advances to IND stage) |

| Recursion | AI-driven drug discovery (phenotypic AI) | Complex (bioinformatics) | N/A | Biotech/pharma | High (novel targets) |

3. Remote Monitoring & Chronic Disease Management

Outpatient care is shifting to patients’ homes. AI-driven remote monitoring (enabled by wearables and sensors) is the trend: continuous data flows are analyzed for early warning signs. For example, AI can identify subtle changes or patterns that may signal potential problems and prompt interventions (like adjusting meds for out-of-range glucose) before a patient deteriorates. Startups specialize in this space like Biofourmis offers a platform of connected sensors and AI analytics to manage heart failure, diabetes and more remotely – its tools track vitals via wearable patches and feed predictions to clinician teams. Livongo (acquired by Teladoc) popularized diabetes management: patients use smart glucose meters, and AI algorithms coach them in real-time based on trends. Dexcom’s G7 continuous glucose monitor is reported as “the most accurate CGM available” cleared by the FDA. The result is personalized, proactive care: hospitalizations and complications are a little less likely when a watchful AI is keeping tabs on daily health.

| Tool | Primary Use | Ease of Use | Pricing | Best For | Output Quality |

|---|---|---|---|---|---|

| Biofourmis | AI-driven remote monitoring for chronic care | Moderate (wearables) | Enterprise/partnered | Hospitals and chronic care programs | High (FDA-registered device + alerts) |

| Livongo | Diabetes management (glucose tracking + coaching) | Consumer-friendly app | Often free via insurance | Patients with diabetes (and Insurers/employers) | High (studies show better glycemic control) |

| Dexcom G7 | Continuous glucose monitoring (CGM) | Easy (wearable sensor) | Per device | Diabetic patients, endocrinologists | High (FDA-approved) |

4. Precision & Personalized Medicine

Medicine is becoming “one-size-fits-one.” AI ties together genomic, proteomic and clinical data to pick the right therapy for each patient. The big trend here is multimodal data integration. Industry leaders are compiling huge libraries of patient data to train AI that recommends treatments. For example, Tempus calls itself an “AI-enabled precision medicine” company with one of the world’s largest multimodal datasets. It uses artificial intelligence to analyze tumors’ genomic profiles along with clinical history to guide oncology treatment and discover new targets. In parallel, Foundation Medicine has established expertise in genomic profiling that informs targeted cancer treatment strategies, while Sophia Genetics delivers a cloud-based AI platform that transforms genomic and radiomic data into actionable clinical insights for cancer and rare disease management, achieving remarkable up to 99% accuracy across multiple data modalities.

The field continues to attract significant strategic partnerships: in 2025 Illumina (genome sequencer giant) teamed up with Tempus to apply AI to genomic medicine, with the goal of making comprehensive molecular testing standard across diseases. Such collaborations signal that harnessing AI on patient DNA and outcomes is seen as the future of targeted care.

| Tool | Primary Use | Ease of Use | Pricing | Best For | Output Quality |

|---|---|---|---|---|---|

| Tempus | AI-driven genomic analysis & clinical decision support | Moderate (lab test) | Custom (labs/hospitals) | Oncologists, genomic labs | High (extensive validation) |

| Foundation Medicine | Genomic profiling and AI-enabled tumor reports | Moderate (lab test) | Per-test pricing (covered by many insurers) | Cancer centers, pathologists | Very High (FDA-approved panels) |

| Sophia Genetics | AI genomics & radiomics platform | Moderate (cloud UI) | Contact Sales | Hospitals, labs | High (98–99% accuracy) |

5. Healthcare Operations & Workflow

Not all AI is clinical. Big efficiency gains are hiding in operations. The trend is automation and predictive management of admin tasks. AI is being used to optimize staffing, scheduling, billing – freeing clinicians from paperwork. For example, LeanTaaS’ iQueue software uses AI to optimize Operating Rooms (OR) and bed scheduling, claiming users “perform 30–50 more cases per OR per year” and generate tens of thousands extra dollars per bed/chair. Qventus can forecast daily patient demand and recommend how many nurses or rooms to allocate to avoid bottlenecks. Other startups (Notable.ai, Waystar’s RCM) apply natural language processing to automatically code visits and populate claims. The goal is smooth logistics: predictive analytics can estimate which patients are likely to be readmitted or which operating rooms will run late. By streamlining admissions, discharge and revenue-cycle management (RCM), AI tools promise leaner hospitals where caregivers “deliver the best possible care” rather than chase charts.

| Tool | Primary Use | Ease of Use | Pricing | Best For | Output Quality |

|---|---|---|---|---|---|

| Notable | Clinical documentation and revenue-cycle automation (voice, chatbots) | User-friendly (UI/workflows) | Subscription | Hospitals and clinics (billing staff) | High (AI typing into Electronic Health Record, or EHR) |

| LeanTaaS | Patient flow and scheduling optimization | Web-dashboard (moderate complexity) | Subscription (enterprise) | Operating rooms, infusion centers | High (proven OR time savings) |

| Qventus | Real-time operational analytics & resource coordination | Moderate (requires integration) | Enterprise contracts | Acute care workflows (nurses/physicians) | High (in use at >100 hospitals) |

6. Medical Robotics & Surgical Assistance

Robots used to be science fiction; now they’re common in ORs. The current trend is new robotic systems and smart assistance. Intuitive Surgical’s da Vinci system still dominates soft-tissue surgery, but challengers are emerging. For example, UK’s CMR Surgical just won FDA clearance (Oct 2024) for its Versius system, a more modular, open-architecture laparoscopic robot designed for smaller incisions. Meanwhile, Medtronic’s Hugo robot (a multi-quadrant soft-tissue platform) filed for US approval in early 2025, marking “the first year Intuitive will face meaningful U.S. competition”. These newer systems promise sleeker instruments and lower costs. In addition, “smart” capabilities are creeping in surgical navigation systems and future robots will likely incorporate AI vision for tissue recognition, real-time feedback, and even autonomous suturing. The result is a next-gen operating room where AI-powered robots assist surgeons with greater precision and efficiency.

| Tool | Primary Use | Ease of Use | Pricing | Best For | Output Quality |

|---|---|---|---|---|---|

| Intuitive (da Vinci) | Robot-assisted minimally invasive surgery | High training curve (console required) | Very high | Complex surgeries | Industry-leading precision |

| CMR Surgical (Versius) | Modular laparoscopic surgery robot | Designed for flexibility | High but lower than incumbents | Hospitals seeking multi-OR capability | High (FDA-cleared workflows) |

| Medtronic (Hugo) | Multi-quadrant soft-tissue surgery robot | Moderate (modular) | Enterprise | Hospitals (urology, hernia, etc.) | High (early trial success) |

7. Patient Interaction & Virtual Assistants

AI is also entering the exam room and home through chatbots and voice assistants. One trend is AI triage/chat tools that let patients consult a “doctor” on their phone. For instance, Infermedica provides a self-triage symptom checker that guides patients to appropriate care levels. Germany’s Ada Health offers similar apps: you enter symptoms and the AI gives probable diagnoses and advice. K Health and Buoy Health also use NLP chatbots for triage. Notably, a study found Buoy’s AI reduced patient uncertainty about care level where only 21% remained unsure vs. 34% before using the tool. These apps are typically free to users (some offer paid premium). They are very easy to use (conversational, mobile apps), and they are becoming a first point of contact for patients, improving access and engagement 24/7.

| Tool | Primary Use | Ease of Use | Pricing | Best For | Output Quality |

|---|---|---|---|---|---|

| Infermedica | AI symptom checker and triage engine | Very easy (web/app) | Contact Sales | Providers, telehealth services | High (guidance-level) |

| Ada Health | AI symptom assessment & advice | Very easy (app) | Freemium | Consumers & clinics | High (clinically validated) |

| Buoy Health | AI symptom checker (chat-based) | Very easy (web) | Enterprise partnerships | Patients, employers | High (reduced uncertainty) |

8. Clinical Decision Support (CDS) & Predictive Analytics

Finally, AI is embedded in countless decision-support tools. Whenever a system flags a sepsis risk or suggests a treatment path, there’s likely an AI model behind it. A key trend here is data-driven risk scores: hospitals train algorithms on EHR data to predict who will decompensate, who will respond to a drug, or who should go home sooner. Surveys suggest 65% of US physicians use AI-based risk scores and alerts regularly.

Companies have leapt in: Merative, formerly known as IBM Watson Health, brings decades of expertise in healthcare data, analytics, and now artificial intelligence to the table. Startups are active too, for example, Corti AI listens in on emergency calls and clinical conversations, flagging cardiac arrests or deteriorating patients in real time. MEDITECH’s CDS integrates predictive analytics directly into electronic health records, nudging clinicians with evidence-based recommendations. These AI tools are transforming healthcare delivery through sophisticated CDS systems that leverage advanced predictive analytics. They are increasingly becoming the backbone of value-based care initiatives, reducing clinical variation and helping providers allocate resources to patients with the greatest need at precisely the right moment.

| Tool | Primary Use | Ease of Use | Pricing | Best For | Output Quality |

|---|---|---|---|---|---|

| Merative | Oncology and imaging decision support | Complex (Enterprise) | Project-based | Cancer centers, hospitals | Moderate (mixed results) |

| Corti AI | Real-time clinical conversation analysis | Easy | Subscription | Emergency & acute care | High (Instant, actionable) |

| MEDITECH | EHR-integrated CDS & predictive analytics | Moderate | Enterprise | Hospitals, health systems | High (Evidence-based) |

Conclusion

From AI co-pilots reading scans to virtual assistants chatting with patients at 2 a.m., the revolution of AI in healthcare is touching every facet of the industry. Much like the stethoscope in the 19th century transformed medicine by revealing the unheard sounds of the body, today’s AI tools are unveiling hidden patterns in data and amplifying the capabilities of clinicians. In this “smart stethoscope” era, decisions become more informed, treatments more personalized, and care more continuous. Hospitals run a bit smoother, drug discoveries get faster, surgeries become safer, and patients find answers quicker.

The best outcomes arise not from AI alone, but from human expertise augmented by AI. These technologies don’t replace healthcare professionals, they empower them. AI becomes an unseen team member that is diligent, tireless, and razor-sharp at processing information, thus enabling humans to focus on empathy and complex judgment.