From product to service: Navigating the transition

At an IMD Discovery Event in April 2013, 75 participants reflected on the challenges of building a service-centric organization, discovered some of the best practices of leading companies and networked with their peers. Executives left better equipped to navigate the transition from the increasingly commoditized product landscape to one offering value-added services.

Companies today fight tooth and nail to maintain margins and grow their business. As a result, many have embarked on the transformation journey – from pushing boxes to providing true service. The opportunities to earn profits by offering services and customer solutions are greater than ever, and the trend reaches beyond business-to-business (B2B) markets.

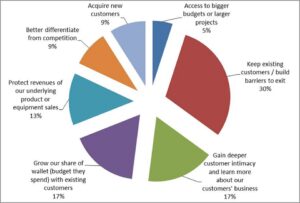

The results of a survey completed by participants before the event show a mixed picture. Services can play the role of both an offensive and a defensive strategy. 59% of executives viewed services as a proactive weapon to grow revenues and profits. At thesame time, 30% of respondents viewed services as a way to keep existing customers and build barriers to entry (see Figure 1). In terms of sales challenges, only 9% of executives thought that salespeople had the right tools to communicate the value of the service to customers, even though 35% thought the sales team understood the value to customers of the service.

Moving from a product-centric to a service-savvy sales force

If companies want to move away from product-related services into more complex customer solutions, managers must take a new look at the sales force. Stephan März, head of the services business unit at Bobst, shared his experience in creating a separate unit dedicated to services. Bobst is a Swiss multinational that makes machines that serve half of the global packaging industry. It is organized into two product business units, with a third service unit working across the two product units; the latter consists of 800 technicians and 50 staff who sell services.

Bobst’s one-brand strategy, in a multinational with several customer-facing teams and hundreds of product families, poses a serious challenge: Customers expect the same high level of professionalism, quality, performance and service ethos across all the divisions and departments. Having listened to customers, März and his colleagues developed a service navigator to describe each element in the service offering. It is organized in four groups: core services assistance (where e-services solutions are a priority); maintenance solutions (ensuring full efficiency of Bobst machines); “Boost my Bobst” (improving productivity and reducing environmental impact); and expert solutions (offering training, coaching and process improvement consulting). Bobst sells services through two main channels: regional service managers, or trusted advisers; and service key account managers for big customers. Currently the machine sales force sells a few services, but the company would like to limit this.

A comprehensive education program – delivered through face-to-face and online modules – covers sales skills, service product skills and finance basics. Bobst did not hesitate to look outside for help in standardizing processes and training its people. In several instances it had to consult experts and coaches. Today, it has an independent service sales force, with its own identity and the ability to explain more complex solutions to customers. A collateral benefit of this endeavor is the emergence of a network of experts and an impressive bank of service product knowledge and capabilities that is captured in a service competencies database.

The road ahead

Companies in many industries face grow-ing competitive pressures and customer expectations to take on more complex jobs. To differentiate and continue to grow, B2B companies must leverage the right resources and develop new capabilities in order to understand, (co-)create, communicate, and deliver value to the customer. During the event, we discovered that many manufacturers have successfully embarked on the transition journey. Is your company next?

Discovery Events are exclusively available to members of IMD’s Corporate Learning Network. To find out more, go to www.imd.org/cln

Research Information & Knowledge Hub for additional information on IMD publications

in Safety and Health Practitioner 29 January 2019

in Harvard Business Review May-June 2024, vol. 102, issue 3

in Safety and Health Practitioner 29 January 2019

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

in Harvard Business Review May-June 2024, vol. 102, issue 3

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications

Research Information & Knowledge Hub for additional information on IMD publications